does wyoming have sales tax on cars

You read it correctly and other tariffs are very convenient to pay. Does wyoming have sales tax.

Can I Register A Car In Another State

However this does not include any potential local or county taxes.

. However some areas can. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. An example of taxed services would be.

The state tax for car sales in Wyoming is 4. You live in Natrona County 5 sales tax Trade. To avoid the fine pay this tax within 60 days of purchasing your vehicle.

Figure the motor vehicle rental. So it automatically decreases the cost of living in. Vehicle Factory cost is 30000.

Wyomings sales tax is 4 percent. We have almost everything on ebay. The state of Wyoming does not usually collect sales taxes on the vast majority of services.

In addition Local and optional taxes can be. If you dont pay it within 60 days youll be penalized the. How much is vehicle sales tax in Wyoming.

For vehicles that are being rented or leased see see taxation of leases and rentals. 2022 Wyoming state sales tax. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

Currently combined sales tax rates in wyoming range from 4 to 6 depending on the location of the sale. What is the sales tax on a car purchased in Wyoming. What is the sales tax on cars in Wyoming.

But what if we tell you there is no Wyoming income tax rate in Wyoming. Cities counties and other municipalities may also have. Use tax applies where the purchase occurred outside of Wyoming and is for the use storage or consumption of the vehicle within Wyoming.

Vehicle factory cost is 30000 You live in Natrona County 5 sales tax With Trade. The Excise Division is comprised of two functional sections. If you dont pay within 60 days youll be slapped with a 25 fine.

How long do you have to pay sales tax on a car in Wyoming. How To Calculate Sales Tax And Vehicle. The state also has several special local and excise taxes.

The state of Wyoming does not usually collect sales taxes on the vast majority of services performed. Are services subject to sales tax in Wyoming. How long do you have to pay sales tax on a car in Wyoming.

Wyoming does have a sales tax which may vary among cities and counties. Some services in Wyoming are subject to sales tax. Wyoming law requires that sales tax must be.

Wyoming law requires that sales tax must be paid on a vehicle within 60 days of the date of purchase. A sales or use tax is due prior to first registration. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is.

Wyoming Use Tax and You. Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used. Exact tax amount may vary for different items.

State wide sales tax is 4. However some areas can have a higher rate. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

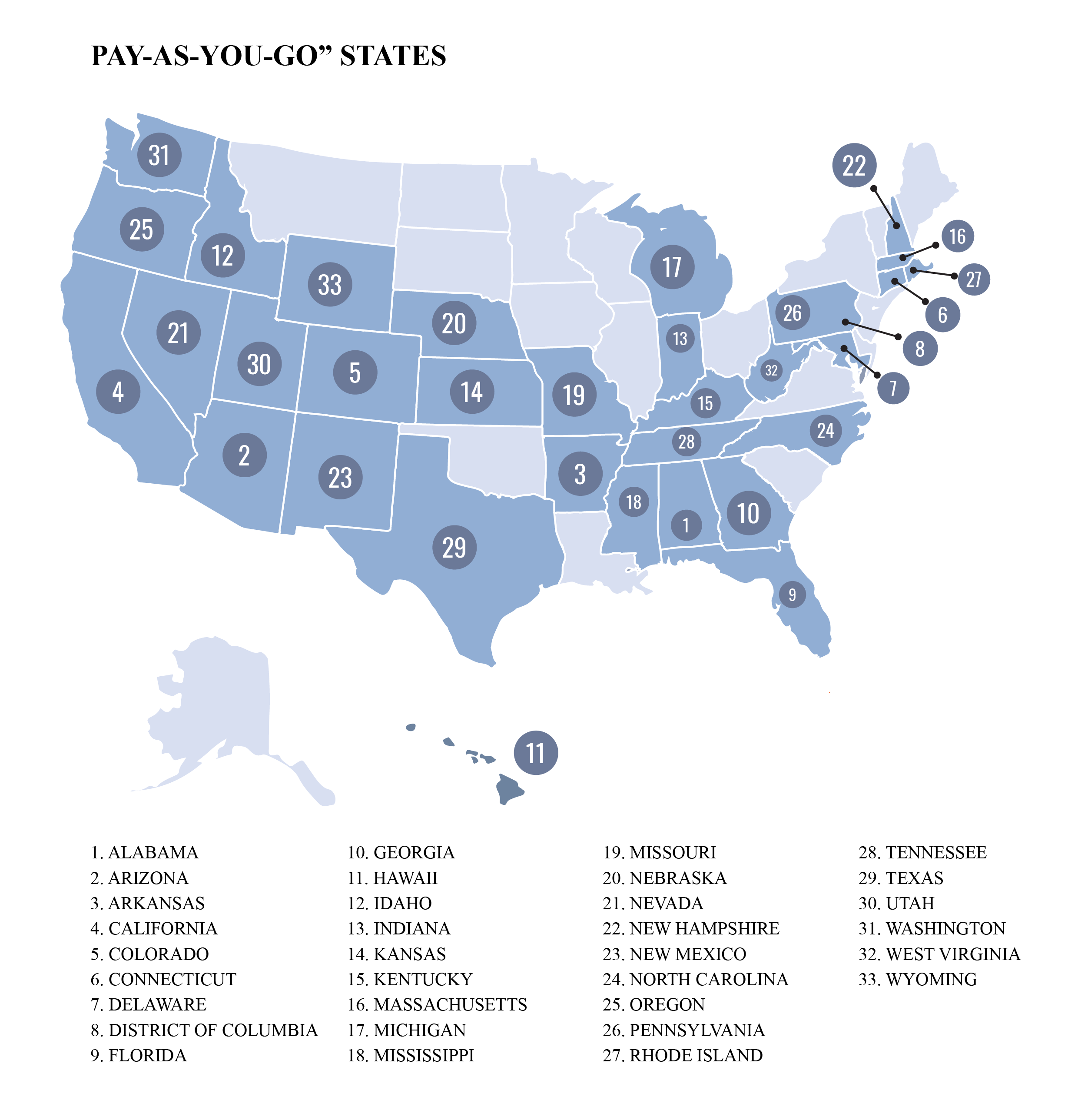

States With No Sales Tax On Cars

Free Wyoming Bill Of Sale Form Pdf Word Legaltemplates

Car Sales Tax In Washington Getjerry Com

Sales Tax On Cars And Vehicles In Utah

What S The Car Sales Tax In Each State Find The Best Car Price

Wyoming Property Tax Appeals Important Dates Savage Browning

Here S Why So Many Exotic Cars Have Montana License Plates Autotrader

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Are You Cash Negative At The Inception Of A Bhph Deal Due To Sales Tax Lhph Capital

Fusion Auto Sales Cars For Sale Wyoming Mi Cargurus

Form 107 Fillable Wy Sales Use Tax Statement For Motor Vehicle Sales

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNIIU3TZ6ZJ7XA6KSWPAXNFHMU.png)

Oklahoma Tax Commission Asking To Shut Down G W Zoo Over Unpaid Sales Tax

Leading Ford Dealer In Torrington Transwest Ford

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Wyoming Wy State Income Tax Information

Pay On Line Uinta County Wy Official Website

States With No Sales Tax On Cars

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price